So what does being financially literate means, to know some basics about how, when and where to spend, save, share and invest your money.

Basically every person should be at least literate enough to manage his money well enough to full fill his current as well as future needs. Being financially literate helps in many ways to use and understand your spending and investment.

Financial literacy is a topic which is not been covered in any school or college. But the importance of it is totally equivalent to math and calculations that has been included in the school and college's syllabus from very beginning. For being successful in life one should know to manage his money well.

In a survey conducted by Forbes it was seen that 90% of the business that have failed in resent times are due to financial mismatch and only 10% are the other reasons like product failures, management disputes, improper idea, etc. Imagine 90% of the businesses failing due to non other than financial mismatch this shows the importance of financial literacy in everyone's life and the topic that must be taught from the high school.

Talking about basics of financial literacy it includes:

4 Jar system of money skills.

INVEST (20% Investment)

SAVE (20% Savings)

SPEND (50% Spending)

SHARE (10 % Sharing)

Person with a fine knowledge about his income and spending. Can make his money skills better by following the basic mantra of three S and I.

And understand four decisions that has to be made considering investing, savings, spending's and sharing. A person who has mastered the mantra of (3S and I) has increased his chances by 50% of being successful in life. As this cycle of (3S and I) itself is 50% of basic financial literacy.

It is believed that a person should only spend 50% of his income and rest 50% can be considered for saving, investing and sharing, And it can be further classified into saving, sharing and investing as per the persons convenience.

This Jar system of money skills was first invented by Jewish and was known as Jewish 5 Jar system of money skill. The 5 jars were tithing, giving, saving, investing and spending. But later for ease of understanding and according to importance it was converted into 4 Jar system i.e investing, saving, spending, sharing. Some people also exclude investing and call it 3 Jar system.

Robert Kiyosaki in his book Rich Dad vs Poor Dad, he has mentioned about 4 quadrants of cash-flow the 4 quadrants include employee and self employed at one side where as business owners and investors at the other side. He says that 90% of the world population fall into left side of the quadrant i.e 90% of the people in the world are employee or self employed but they contribute only 10% to the world's wealth where as towards the right side of the quadrant are the business owners and professional investors. And this are only 10% of the world's population but they contribute 90% to the world's wealth.

He defines left side being poor dad where as right side being rich dad. Now how to move from left side of the quadrants to right side for being rich dad to do so we have to understand how does income works and follow 4 Jar system of money skills.

Active Income

Active income can be defined as money earned by performing any kind of work in terms of physical or it may be mental. If you work for a firm or organization and you get a salary, wages, bonus, commission, etc. they are termed as active income.

Passive income can be defined as an form of money earned by system that we have created and it creates wealth for us in terms of constant income. If we start a company, write blogs, earn royalties, Create MLM (Multi level marketing) chain or do affiliate marketing and we earn wealth or income through that it would be called as passive income.

"Find a way to earn money while you sleep or else you gonna end up working until you die"

Passive Income.

Portfolio Income

Where active income is acquired by exchanging time or money, portfolio income is made through capital gains. If we invest in stock market, mutual funds, shares or currency exchange the income earned through all of this is termed as portfolio income.

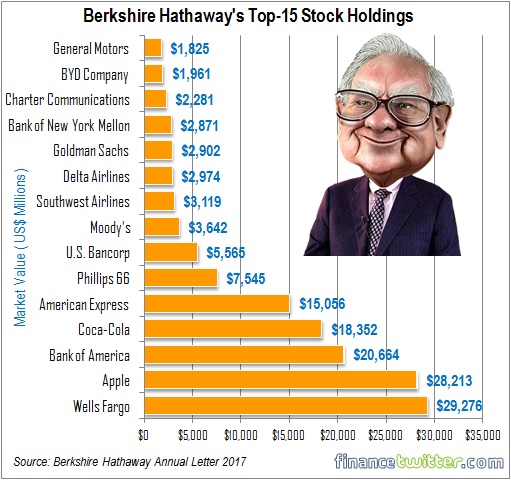

When we talk about best example for person with portfolio income we can not forget Warren Buffet he is one of the greatest investor of all time according to me. He started investing in stock market at the age of 13. Talking about his shares in top firms, below chart explains it all.

0 comments:

Post a Comment